Chipmakers' quest for wafers supply affirms SiC adoption

- Automotive

- 2023-09-23 21:29:22

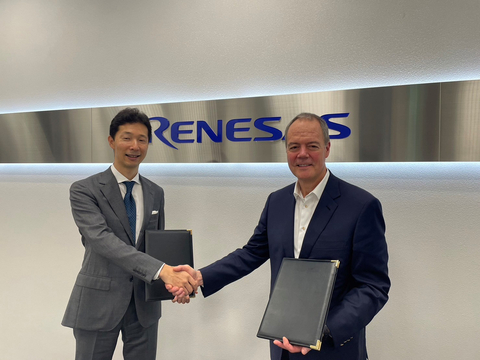

Renesas signing a 10-year supply agreement with Wolfspeed for silicon carbide (SiC) bare and epitaxial wafers is another stark reminder of an industry-wide transition from silicon to SiC semiconductor power devices across multiple high-volume applications spanning electric vehicles (EVs), renewable energy and storage, charging infrastructure, industrial power supplies, and traction and variable speed drives.

What’s also worth noting is that Renesas will make a deposit of $2 billion to secure the supply in this multi-decade agreement starting in 2025. This $2 billion deposit will support Wolfspeed’s ongoing capacity-building projects, including John Palmour Manufacturing Center for Silicon Carbide or the JP, the world’s largest SiC materials plant in Chatham County, North Carolina. The JP is targeted to generate a more than 10-fold increase from Wolfspeed’s current SiC production capacity in its Durham, North Carolina facility.

That also means that while Wolfspeed will start providing Renesas with 150-mm SiC bare and epitaxial wafers in 2025, the arrangement will eventually expand to 200-mm wafers when the JP is fully operational. And it’s not the only multi-year, multi-country arrangement expanding from 150-mm to 200-mm SiC wafers.

A couple of months ago, Infineon signed a pact with Chinese SiC materials supplier TanKeBlue to secure additional SiC wafers. While the agreement will focus on 150-mm SiC material in the first phase, TanKeBlue will also provide 200-mm SiC material to support Infineon’s transition to 200-mm wafers. Likewise, Qorvo has recently finalized a multi-year supply agreement for SiC bare and epitaxial wafers with SK Siltron CSS, a semiconductor wafer manufacturer based in South Korea.

The multi-year aspect of these deals underscores that SiC semiconductor suppliers are confident of SiC adoption in automotive, industrial, and energy markets. As a result, they are keen to ensure a stable, long-term supply base of high-quality SiC wafers. The second revelation from these announcements is the keenly awaited transition from 150-mm to 200-mm SiC wafers, as it will translate into more chips per wafer and thus lower device costs.

Related Content

SiC and GaN: A Tale of Two SemiconductorsWafer supply deals herald the upcoming SiC boomSiC and resurgence of semiconductor vertical integrationSilicon carbide (SiC) and the road to 800-V electric vehiclesAPEC 2023: SiC moving into mainstream, cost major barrierChipmakers' quest for wafers supply affirms SiC adoption由Voice of the EngineerAutomotiveColumn releasethank you for your recognition of Voice of the Engineer and for our original works As well as the favor of the article, you are very welcome to share it on your personal website or circle of friends, but please indicate the source of the article when reprinting it.“Chipmakers' quest for wafers supply affirms SiC adoption”