A closer look at the first made

- Communications

- 2023-09-23 21:39:47

Huawei’s new system-on-chip (SoC) for 5G smartphones manufactured at SMIC’s 7-nm process node is making waves in the trade media, and it’s widely hailed a victory for China in the backdrop of semiconductor technology restrictions imposed by the United States and its allies. TechInsight’s recent teardown of Huawei Mate 60 Pro smartphone and reports published in multiple publications—including South China Morning Post and Tom’s Hardware—provide some details about Huawei’s Kirin 9000S 5G handset SoC.

Figure 1 The Mate 60 Pro smartphone is reportedly built around the first made-in-China 5G chip: Kirin 9000S. Source: Huawei

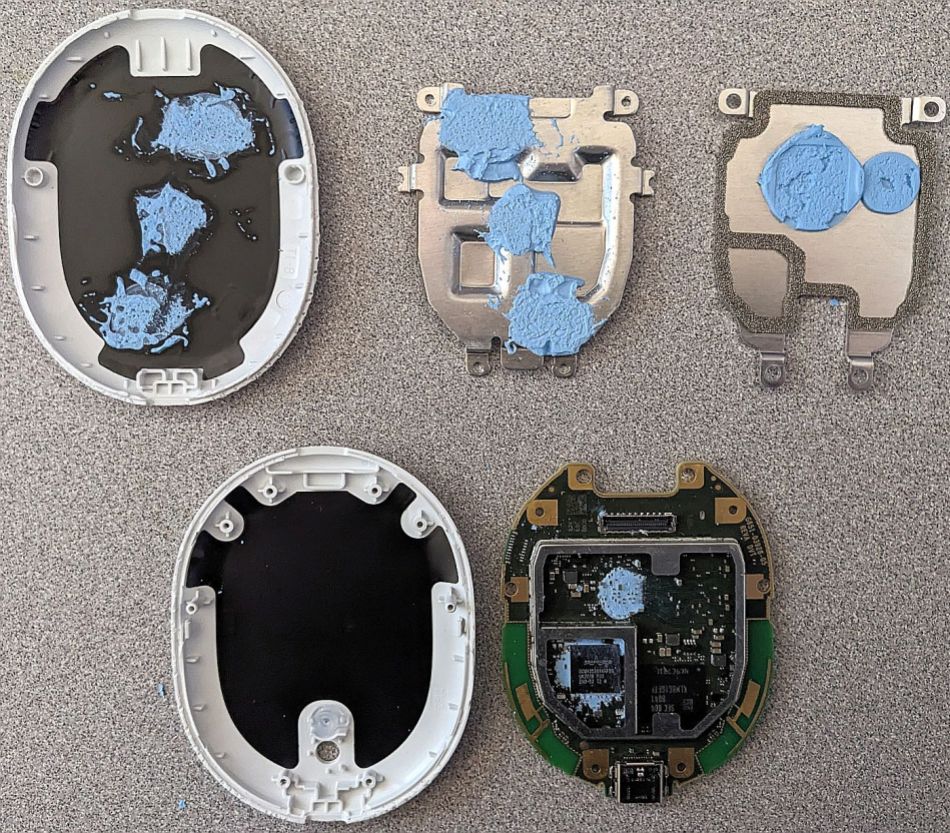

The reports suggest that Huawei’s new SoC comprises four high-performance cores, four energy-efficient cores and the Maleoon 910 GPU, and that the SoC is most likely built around the Armv8a ISA. These reports also anticipate that Kirin 9000S stacks the modem chip on top of the CPU+GPU chip to save space on the motherboard. Furthermore, CPU and GPU cores in this 5G SoC run at relatively low clocks compared to frequencies of Arm’s cores featured in previous generations of SoCs developed by HiSilicon, Huawei’s in-house semiconductor unit.

That mostly likely relates to SMIC’s efforts to simply production at its second-generation 7-nm fabrication process, also called N+2. China’s top foundry has been denied access to extreme ultraviolet (EUV) lithography equipment, so it managed to produce the first-generation ‘N+1’ process built around the older deep ultraviolet (DUV) lithography technology. It’s reported to be close to an equivalent to TSMC’s 7-nm process based on the EUV technology.

SMIC’s quest for smaller nodes

It’s important to note that SMIC’s DUV lithography scanners can produce chips at 7-nm and 5-nm process nodes, which make heavy use multi-patterning, an expensive technology affecting manufacturing yields and costs. In other words, it prioritizes functionality over high production volumes.

SMIC’s other 7-nm chip produced for China’s bitcoin miner Bitman Technologies was less sensitive to this business realization as it was manufactured in smaller quantities. However, yield issues become critical when produced for a mass-market item like a 5G mobile handset. In a story recently published in Nikkei Asia, Nomura Securities analyst Donnie Teng estimates the production yield for SMIC’s 7-nm node at about 50%. “The production yield for a 7-nm node is believed to be quite low, and it still has lots of room for improvement.”

Figure 2 It’s believed that Huawei may have disaggregated some logic in Kirin 9000S to simplify production for SMIC. Source: Bloomberg

So, while it’s clear that Huawei is willing to invest a lot in having powerful chips manufactured on the latest process nodes, will the telecon and cloud computing giant maintain production scale and profitability in the long run? A lot has changed for Huawei and its semiconductor arm, HiSilicon, in the past few years.

In 2019, Huawei was the world’s second-largest smartphone maker, training behind Samsung. Moreover, like Apple, Huawei was then TSMC’s top customer and an early adopter of its cutting-edge process technologies.

During those days, HiSilicon was emerging as a prominent semiconductor house. Then, in 2020, it lost access to the latest EDA tools and TSMC’s cutting-edge process nodes amid technology export restrictions from the United States and its allies. Back in 2019, HiSilicon claimed to have produced the world’s first 5G SoC, Kirin 990, manufactured using TSMC’s 7-nm EUV process.

HiSilicon also displayed its technology prowess by integrating the modem chip and application processor into Kirin 990. Fast forward to 2023, while TSMC is producing chips on 4-nm and 3-nm process nodes, Huawei has resorted to SMIC and its DUV-based 7-nm node. It’s currently the most advanced process node available in China. Otherwise, Huawei has access to only 4G chips from international semiconductor markets outside China.

Billion-dollar question

Huawei’s return to the 5G market and its collaboration with SMIC to produce a 7-nm chip have sparked enthusiasm in China amid the ongoing Sino-U.S. high-tech tensions. But this breakthrough also leads to a fundamental question.

Amid the manufacturing yield issue, can SMIC produce 5G chips that can compete with Qualcomm and MediaTek? According to Counterpoint analyst Ivan Lam, achieving commercial-scale profitability could be a challenge for SMIC. At the same time, Huawei will have to spend a lot of money to restore its chip supplies.

Figure 3 The breakthrough in 5G chip production shows that system houses in China are willing to invest a lot to stabilize their chip supply. Source: Huawei

Kirin 9000S is undoubtedly the first fruit of collaboration between two important technology players in China, striving to become self-reliant in the semiconductor space. However, a closer look at this technology saga reveals that it will be an uphill battle both for SMIC and chip developers like HiSilicon.

Related Content

U.S.-China Crisis: Fallout for Chip IndustryU.S. Ban on Huawei Seen Widening China Chip WarThe truth about SMIC’s 7-nm chip fabrication ordealHuawei, Qualcomm, Samsung Reveal Integrated 5G ChipsSMIC at 7-nm semiconductor process node: A Shanghai surprise?A closer look at the first made由Voice of the EngineerCommunicationsColumn releasethank you for your recognition of Voice of the Engineer and for our original works As well as the favor of the article, you are very welcome to share it on your personal website or circle of friends, but please indicate the source of the article when reprinting it.“A closer look at the first made”