Arm's prototype chips: What it means for the IC industry?

- ICDesign

- 2023-09-23 23:01:25

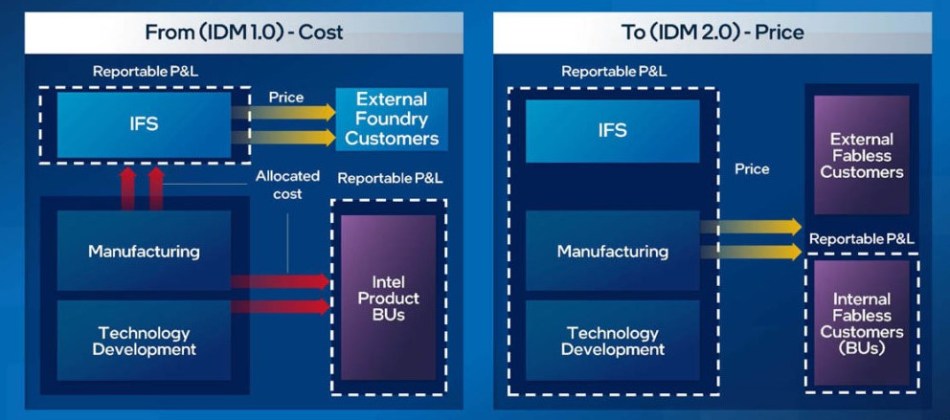

After announcing to increase prices of its processor IPs and joining hands with Intel for tying its mobile system-on-chip (SoC) designs with the 18A process of Intel Foundry Services (IFS), Arm has come up with another major pre-IPO initiative. According to a Financial Times story, Arm has embarked upon the most advanced chipmaking effort to demonstrate the power and capabilities of its designs to the wider market.

It’s worth mentioning that Arm has built some test chips in the past with partners such as Samsung and TSMC, but that was largely aimed at enabling software developers to gain familiarity with Arm’s new products. This one is a more advanced undertaking than ever before; a solutions-engineering team will lead the development of prototype chips for mobile devices, laptops, and other electronics applications.

Kevork Kechichian will lead this solutions-engineering team for building prototype chips. He joined Arm’s executive team in February 2023 after previous stints at NXP and Qualcomm, where he oversaw the development of Qualcomm’s Snapdragon chips.

It’d be interesting to watch how chip suppliers—Arm’s customers—respond to this move. People at Arm are quick to point out that the Cambridge, UK-based company has no plans to sell or license the chip and that it’s only working on a prototype. It’s crucial because Arm has hugely benefited from its position as being chip supplier agnostic, selling processor IP cores to chip designers while not directly competing with them.

However, Arm has recently telegraphed signs that it’s open to overhauling its decades-old business model. For instance, in its recently published annual report, Arm acknowledged that its significant customer base concentration is a major risk to its business. In 2022, Arm’s top 20 customers accounted for 86% of its revenues. That’s crucial in the backdrop of Arm’s current legal dispute with Qualcomm, one of its largest customers.

On the surface, the move looks akin to Google’s benchmarking of smartphone hardware for Android OS with the Pixel phone. Brady Wang, a semiconductor analyst with Counterpoint Research, told Financial Times that the move is similar to Google building Pixel phones and Microsoft launching Surface laptops. Arm sources also claim that the new team building prototype chips is aiming to expand on the company’s existing efforts to enhance the performance and security of designs and bolster developer access to its IP products.

However, when seen in the backdrop of SoftBank’s push for growth and seeking out changes to its commercial practices, the implications of this move could go far beyond the intentions telegraphed by Arm in the Financial Times story. Far more could unravel soon as Arm nears its IPO.

Related Content

SK hynix Looking to Buy ArmArm debuts powerhouse Cortex-M processorSpacecraft data handling using ARM-based processorsDesigning With ARM–Looking back and looking forwardProduct How To: DFT strategy for ARM processor-based designsArm's prototype chips: What it means for the IC industry?由Voice of the EngineerICDesignColumn releasethank you for your recognition of Voice of the Engineer and for our original works As well as the favor of the article, you are very welcome to share it on your personal website or circle of friends, but please indicate the source of the article when reprinting it.“Arm's prototype chips: What it means for the IC industry?”